Does North Carolina Have City Income Tax . — north carolina state tax includes a flat personal income tax rate of 4.5%. The average effective property tax rate for the state is below the national. — compared to the averages for the other states, north carolina collects relatively more of its total state and local taxes from the general. North carolina has a 2.5 percent corporate income tax. These are the ones to watch for. — north carolina now has a flat state income tax rate of 4.75%. The state's sales taxes are generally considered to be near the. north carolina has a flat 4.50 percent individual income tax rate. — north carolina has a flat income tax rate, which means residents pay the same individual income tax rate.

from www.signnow.com

north carolina has a flat 4.50 percent individual income tax rate. North carolina has a 2.5 percent corporate income tax. — north carolina now has a flat state income tax rate of 4.75%. — north carolina state tax includes a flat personal income tax rate of 4.5%. — north carolina has a flat income tax rate, which means residents pay the same individual income tax rate. These are the ones to watch for. The average effective property tax rate for the state is below the national. — compared to the averages for the other states, north carolina collects relatively more of its total state and local taxes from the general. The state's sales taxes are generally considered to be near the.

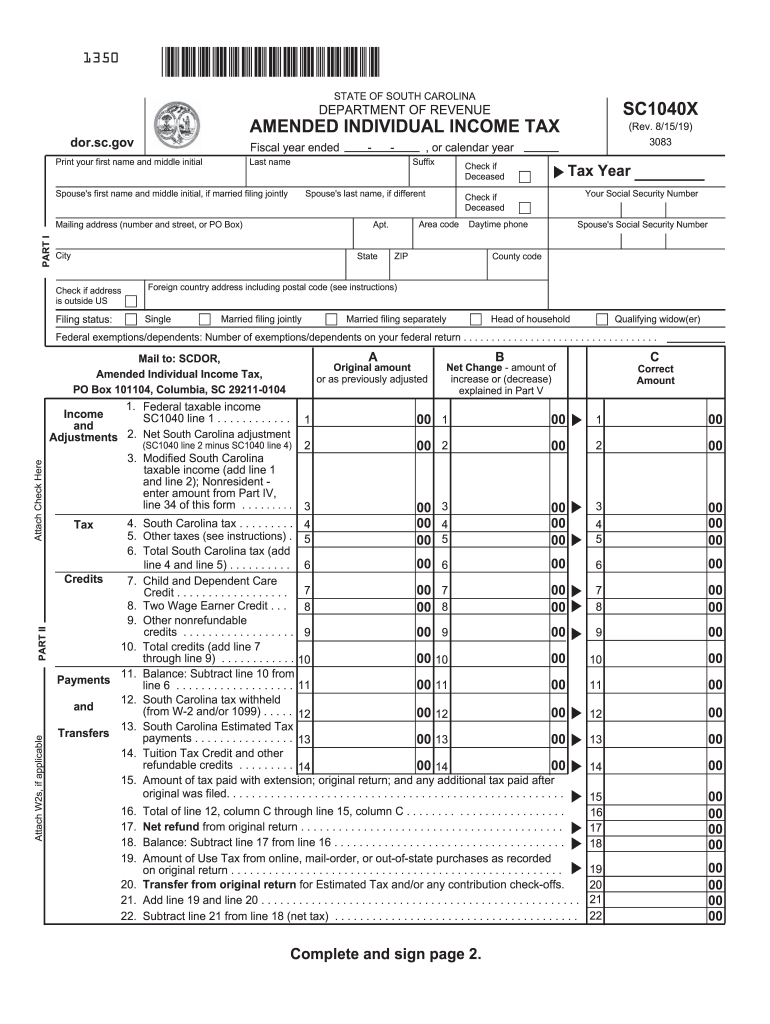

Does South Carolina Have State Tax 20192024 Form Fill Out and

Does North Carolina Have City Income Tax north carolina has a flat 4.50 percent individual income tax rate. The average effective property tax rate for the state is below the national. North carolina has a 2.5 percent corporate income tax. — compared to the averages for the other states, north carolina collects relatively more of its total state and local taxes from the general. The state's sales taxes are generally considered to be near the. north carolina has a flat 4.50 percent individual income tax rate. — north carolina has a flat income tax rate, which means residents pay the same individual income tax rate. These are the ones to watch for. — north carolina now has a flat state income tax rate of 4.75%. — north carolina state tax includes a flat personal income tax rate of 4.5%.

From www.uslegalforms.com

North Carolina Estimated Tax Payments 20202022 20202022 Fill and Does North Carolina Have City Income Tax — north carolina state tax includes a flat personal income tax rate of 4.5%. — north carolina has a flat income tax rate, which means residents pay the same individual income tax rate. north carolina has a flat 4.50 percent individual income tax rate. The state's sales taxes are generally considered to be near the. These are. Does North Carolina Have City Income Tax.

From printabledomatowose.z14.web.core.windows.net

North Carolina Tax Rates 2024 Does North Carolina Have City Income Tax These are the ones to watch for. — compared to the averages for the other states, north carolina collects relatively more of its total state and local taxes from the general. — north carolina has a flat income tax rate, which means residents pay the same individual income tax rate. — north carolina state tax includes a. Does North Carolina Have City Income Tax.

From www.formsbirds.com

Individual Tax Return North Carolina Free Download Does North Carolina Have City Income Tax The state's sales taxes are generally considered to be near the. — compared to the averages for the other states, north carolina collects relatively more of its total state and local taxes from the general. — north carolina has a flat income tax rate, which means residents pay the same individual income tax rate. North carolina has a. Does North Carolina Have City Income Tax.

From www.formsbirds.com

Individual Tax Return North Carolina Free Download Does North Carolina Have City Income Tax These are the ones to watch for. The state's sales taxes are generally considered to be near the. north carolina has a flat 4.50 percent individual income tax rate. — north carolina state tax includes a flat personal income tax rate of 4.5%. — north carolina has a flat income tax rate, which means residents pay the. Does North Carolina Have City Income Tax.

From perfect-free.typepad.com

How should North Carolina slice the tax revenue pie? The Perfect and Does North Carolina Have City Income Tax These are the ones to watch for. north carolina has a flat 4.50 percent individual income tax rate. — north carolina has a flat income tax rate, which means residents pay the same individual income tax rate. — compared to the averages for the other states, north carolina collects relatively more of its total state and local. Does North Carolina Have City Income Tax.

From www.scribd.com

North Carolina Individual Tax Instructions Efile PDF Tax Does North Carolina Have City Income Tax — north carolina now has a flat state income tax rate of 4.75%. — compared to the averages for the other states, north carolina collects relatively more of its total state and local taxes from the general. North carolina has a 2.5 percent corporate income tax. north carolina has a flat 4.50 percent individual income tax rate.. Does North Carolina Have City Income Tax.

From www.ncfamily.org

North Carolina Rockets Up Tax Rankings Does North Carolina Have City Income Tax — north carolina has a flat income tax rate, which means residents pay the same individual income tax rate. These are the ones to watch for. The average effective property tax rate for the state is below the national. The state's sales taxes are generally considered to be near the. — compared to the averages for the other. Does North Carolina Have City Income Tax.

From itep.org

New Jersey Who Pays? 6th Edition ITEP Does North Carolina Have City Income Tax These are the ones to watch for. — compared to the averages for the other states, north carolina collects relatively more of its total state and local taxes from the general. — north carolina state tax includes a flat personal income tax rate of 4.5%. The state's sales taxes are generally considered to be near the. —. Does North Carolina Have City Income Tax.

From www.keepertax.com

Quarterly Tax Calculator Calculate Estimated Taxes Does North Carolina Have City Income Tax These are the ones to watch for. The average effective property tax rate for the state is below the national. North carolina has a 2.5 percent corporate income tax. — compared to the averages for the other states, north carolina collects relatively more of its total state and local taxes from the general. — north carolina state tax. Does North Carolina Have City Income Tax.

From dolleyqmikaela.pages.dev

North Carolina 2024 Tax Rate Vivie Jocelyne Does North Carolina Have City Income Tax The average effective property tax rate for the state is below the national. north carolina has a flat 4.50 percent individual income tax rate. North carolina has a 2.5 percent corporate income tax. — north carolina state tax includes a flat personal income tax rate of 4.5%. — compared to the averages for the other states, north. Does North Carolina Have City Income Tax.

From taxfoundation.org

North Carolina Tax Reform Options A Guide to Fair, Simple, ProGrowth Does North Carolina Have City Income Tax — compared to the averages for the other states, north carolina collects relatively more of its total state and local taxes from the general. North carolina has a 2.5 percent corporate income tax. north carolina has a flat 4.50 percent individual income tax rate. These are the ones to watch for. The state's sales taxes are generally considered. Does North Carolina Have City Income Tax.

From us.icalculator.info

Virginia State Tax Tables 2023 US iCalculator™ Does North Carolina Have City Income Tax — compared to the averages for the other states, north carolina collects relatively more of its total state and local taxes from the general. North carolina has a 2.5 percent corporate income tax. The state's sales taxes are generally considered to be near the. These are the ones to watch for. — north carolina state tax includes a. Does North Carolina Have City Income Tax.

From www.worldatlas.com

North Carolina Maps & Facts World Atlas Does North Carolina Have City Income Tax north carolina has a flat 4.50 percent individual income tax rate. — north carolina has a flat income tax rate, which means residents pay the same individual income tax rate. The average effective property tax rate for the state is below the national. North carolina has a 2.5 percent corporate income tax. — north carolina now has. Does North Carolina Have City Income Tax.

From www.ncjustice.org

North Carolina’s Tax Rates are Among the Lowest in the Nation North Does North Carolina Have City Income Tax These are the ones to watch for. — north carolina state tax includes a flat personal income tax rate of 4.5%. The state's sales taxes are generally considered to be near the. The average effective property tax rate for the state is below the national. — north carolina has a flat income tax rate, which means residents pay. Does North Carolina Have City Income Tax.

From dxobjozez.blob.core.windows.net

Map Of North Carolina Showing Davidson at Walter Straub blog Does North Carolina Have City Income Tax — north carolina state tax includes a flat personal income tax rate of 4.5%. The average effective property tax rate for the state is below the national. — compared to the averages for the other states, north carolina collects relatively more of its total state and local taxes from the general. The state's sales taxes are generally considered. Does North Carolina Have City Income Tax.

From printablethereynara.z14.web.core.windows.net

North Carolina Sales And Use Tax Rates 2023 Does North Carolina Have City Income Tax The average effective property tax rate for the state is below the national. These are the ones to watch for. The state's sales taxes are generally considered to be near the. — north carolina now has a flat state income tax rate of 4.75%. north carolina has a flat 4.50 percent individual income tax rate. — north. Does North Carolina Have City Income Tax.

From www.johnlocke.org

North Carolina At A Glance Taxes John Locke Foundation John Locke Does North Carolina Have City Income Tax — compared to the averages for the other states, north carolina collects relatively more of its total state and local taxes from the general. north carolina has a flat 4.50 percent individual income tax rate. — north carolina state tax includes a flat personal income tax rate of 4.5%. These are the ones to watch for. The. Does North Carolina Have City Income Tax.

From www.ezhomesearch.com

The Ultimate Guide to North Carolina Property Taxes Does North Carolina Have City Income Tax The average effective property tax rate for the state is below the national. North carolina has a 2.5 percent corporate income tax. — north carolina has a flat income tax rate, which means residents pay the same individual income tax rate. These are the ones to watch for. — north carolina state tax includes a flat personal income. Does North Carolina Have City Income Tax.